Craft Founder Chat: Operating in a Downturn

Part deux | 2022 | 26 pages

Operating During a Downturn Part II May 13, 2022 855 Front Street | San Francisco, CA | craftventures.com | Proprietary and Confidential

Agenda 1. What’s happening in public markets 2. What’s happening in venture markets 3. We’ve been here before 4. What you can do about it

1. What’s happening in public markets

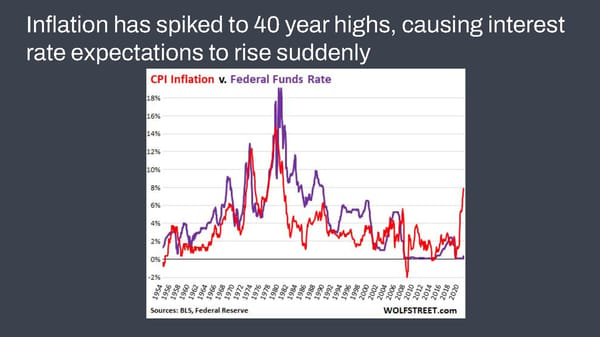

Inflation has spiked to 40 year highs, causing interest rate expectations to rise suddenly

The Fed has indicated it will raise rates to fight inflation, even if it hurts the economy

Long-term rates have already adjusted

Stocks move in the opposite direction as interest rates

Growth stocks get hit the hardest Company % off 52 Week High Enterprise Value EV / Revenue Run Rate Affirm -89% $2.6B 1.8x Asana -86% $3.4B 7.7x Shopify -79% $38.3B 7.9x Zoom Video -79% $20.0B 4.7x Monday -78% $3.6B 9.4x TOAST -78% $6.5B 3.2x DocuSign -77% $13.8B 5.9x Twilio -76% $13.8B 3.9x Okta -68% $13.0B 8.5x Snowflake -65% $40.4B 26.3x

SaaS Index – Public Multiples (Enterprise Value / ARR)

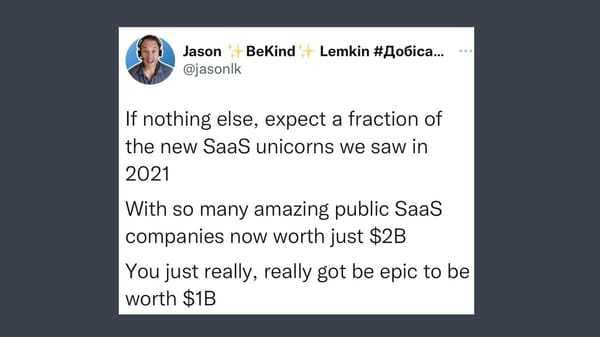

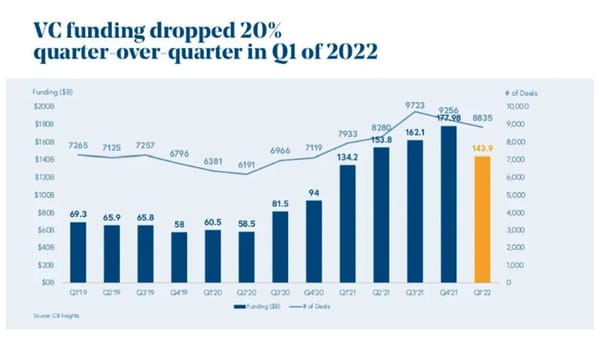

2.What’s happening in venture markets

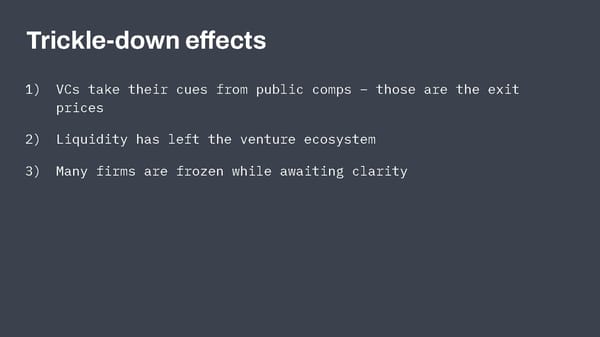

Trickle-down effects 1) VCs take their cues from public comps – those are the exit prices 2) Liquidity has left the venture ecosystem 3) Many firms are frozen while awaiting clarity

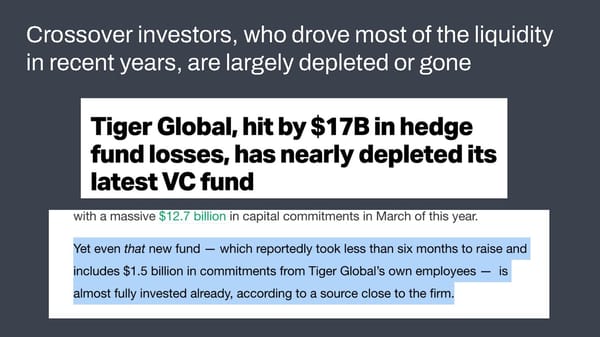

Crossover investors, who drove most of the liquidity in recent years, are largely depleted or gone

Early-Stage Affected Too, not just Growth

Q2 will be significantly worse

3.We’ve been here before

How does this compare? 1) Dot.com Crash of 2000-2002 ~2.5 to 3 years - Excessive speculation of internet companies - Fueled by bull market of late 1990s - abundance of venture capital - Resulted in mass layoffs, bankruptcies 2) Great Recession of 2008-2009 ~1.5 years - Asset bubble concentrated in real estate market - Cratered whole economy 3) Post-Covid Recession of 2022-202? - Tech/growth companies are most affected - Inflated valuations driven by 10+ years of low interest rates - Correction caused by expectation of rising interest rates

4.What you can do about it

Fundraising bar is higher, but still possible Great Good Danger Zone Growth 3x 2.5x Under 2x Gross Margins 70% 50% Under 20% Net Dollar 140% 120% Under 100% Retention CAC Payback 6-12 months 12-18 months Over 24 months Burn Multiple 1 or less 1.0-1.5 Over 2

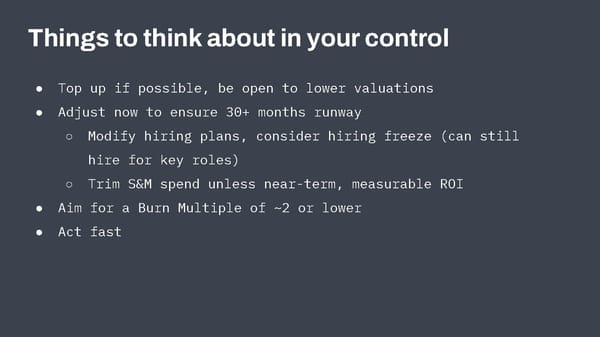

Things to think about in your control ● Top up if possible, be open to lower valuations ● Adjust now to ensure 30+ months runway ○ Modify hiring plans, consider hiring freeze (can still hire for key roles) ○ Trim S&M spend unless near-term, measurable ROI ● Aim for a Burn Multiple of ~2 or lower ● Act fast

The good news ● Some of the most iconic companies were founded in recessions: ○ Google, Amazon, Salesforce, Airbnb, Stripe, PayPal ● Everything gets easier, except raising $$ ● Opportunity to course correct; focus on fundamentals ● You can do it; we are here to help ● The world will keep spinning

Q&A