TLDR

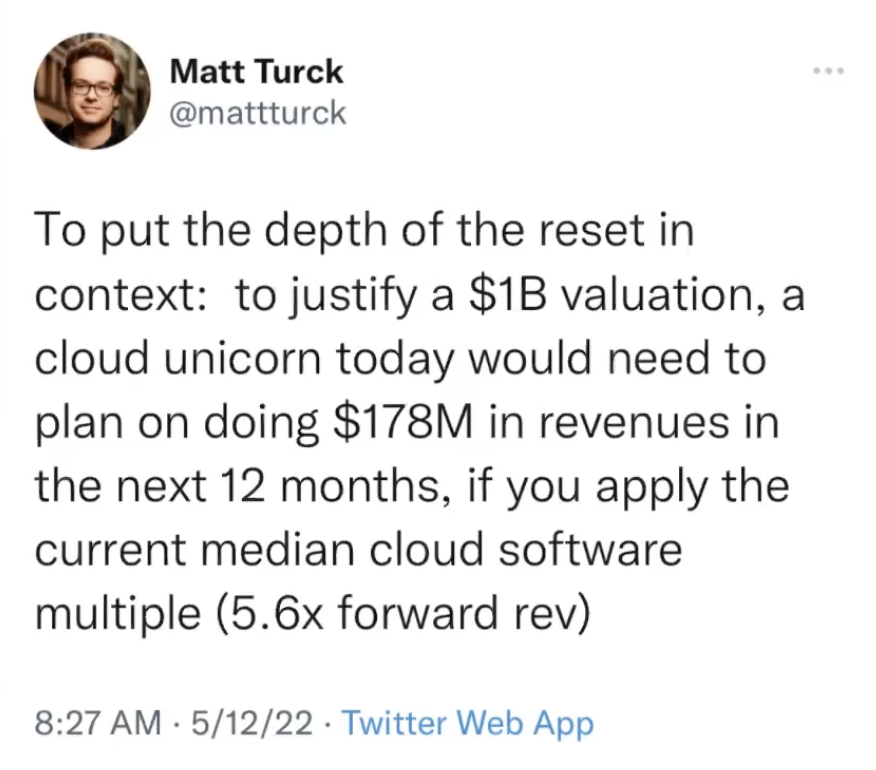

- inflation and interest rate expectations are causing corrections in valuation multiples of public growth stocks

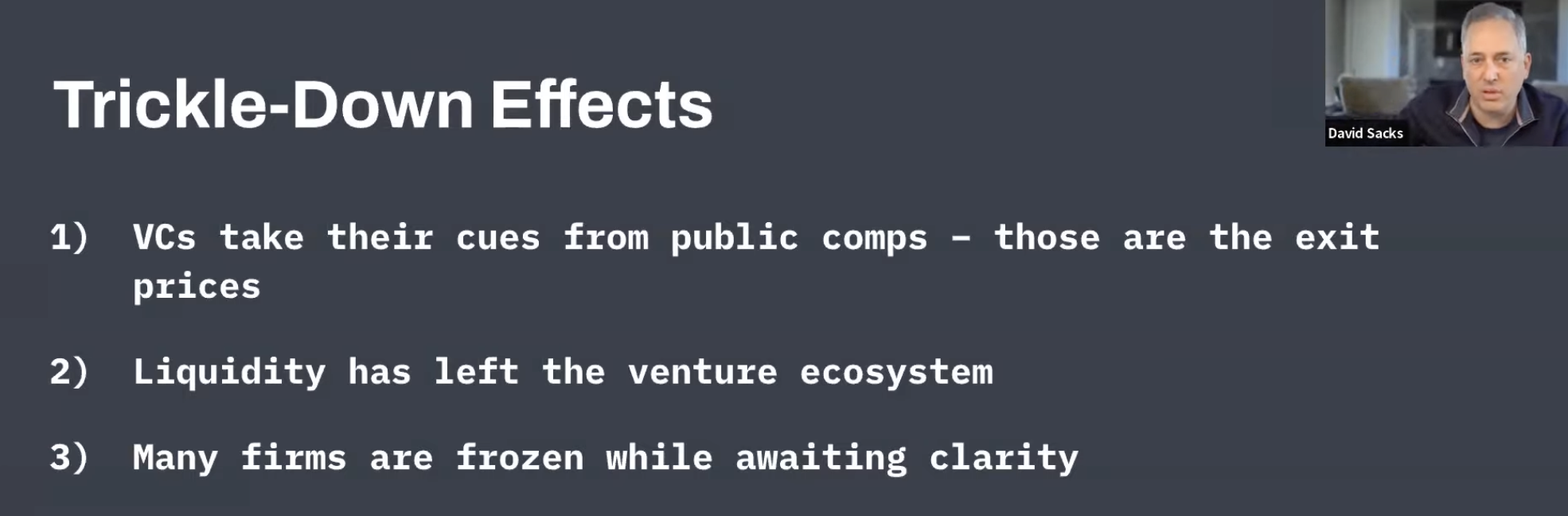

- this trickles down as VCs take their cues from public markets (it's their exit price)

- crossover investors (i.e. not pure VCs) who drove most of the VC liquidity in recent years are largely depleted (e.g. Tiger Global almost fully deployed a $12bn fund raised in less than 6mo last year)

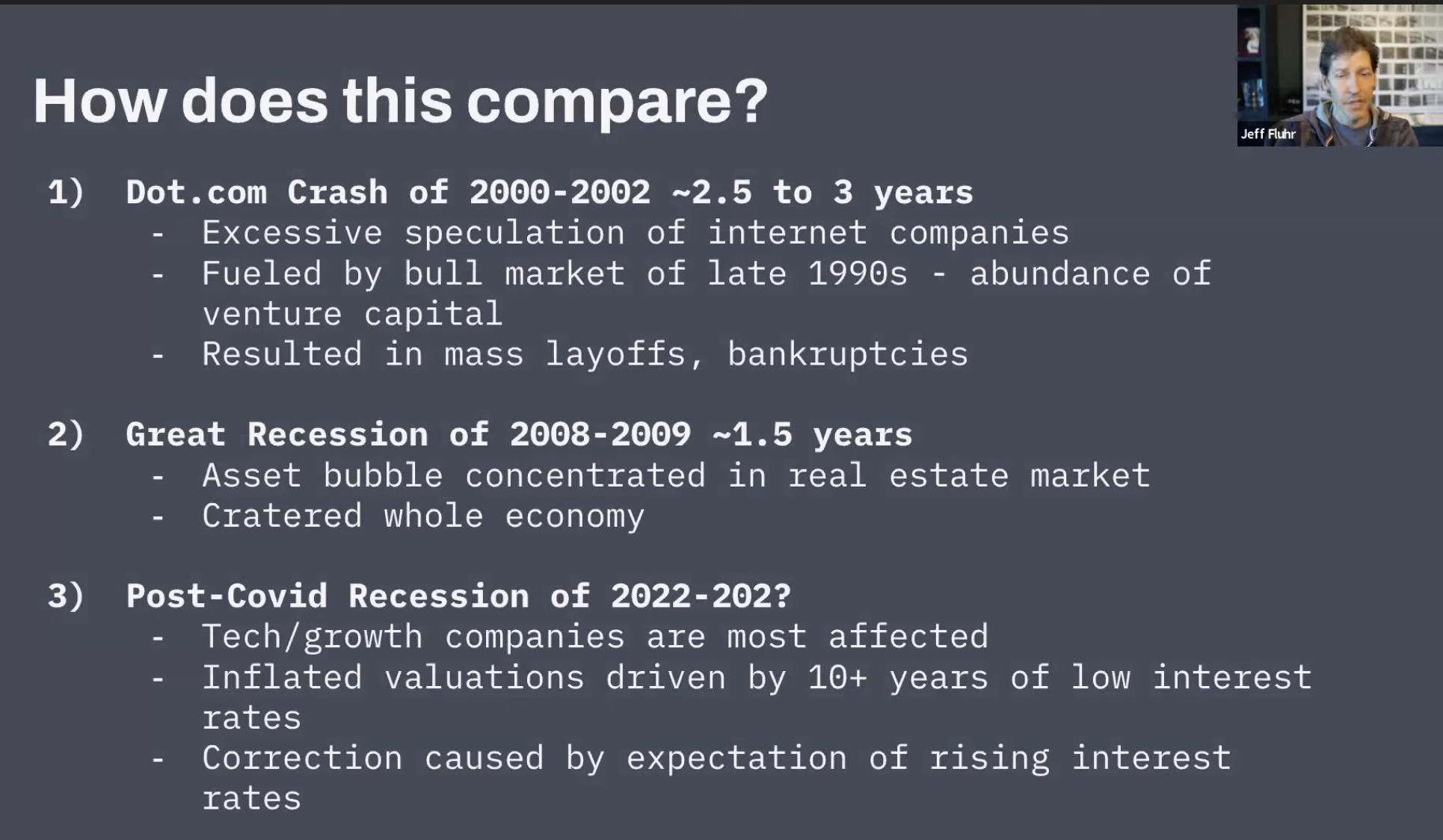

- dot.com crash resulted in layoffs and bankruptcies

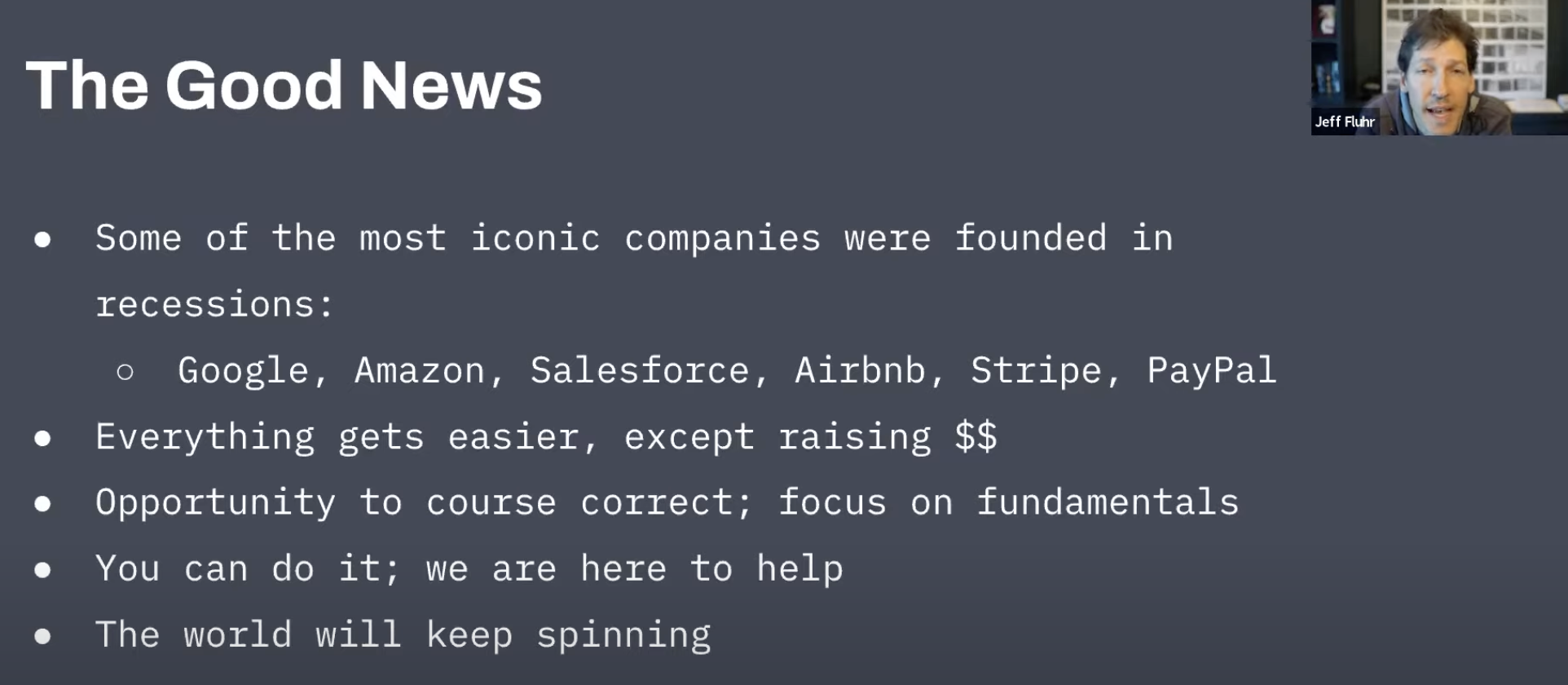

- raise if possible, be open to lower valuations (you want to start raising with 9mo of run-way)

- adjust now to ensure 30+ months runway and you're in the "great" column (incl. hiring plans), "act fast"

Raw notes:

Public market are compressing multiples for growth companies (not necessarily a change in revenues yet)

Indices are heavily weighted towards large caps (Google etc) so they hide the drop in growth stock prices

Public markets are adjusting SaaS multiples down

How does this translate into VC

Ventures markets have basically followed the same trajectory as public markets

Even Tiger Global which raised a $12bn fund last year has already deployed most of that capital. VC funds are also slowing deployment down from 1 to 3 years.

Historical context

What you can do today

Read more about burn multiple by David Sacks: The Burn Multiple

top up if possible, be open to lower valuations.

You really need to raise money with 9 months of runway.

a lot of other things get easier, e.g. hiring. In these markets it gets easier hiring, companies are doing layoffs and hiring less aggressively.

Q&A

The first thing you have to do is basically assess your eligibility to raise (see great, good, danger columns). Merely good numbers may not be enough. If you are in the danger zone you have to adjust your metrics asap. Don't wait too late.

Corrections in public markets are mostly coming multiple compression not necessarily changes in revenues.

anyone that isn't helping you reach product market fit doesn't need to be on the team yet.